The Hong Kong-based JMC Capital Group, founded in 2017, connects to mainland China and extends its business presence into global markets.

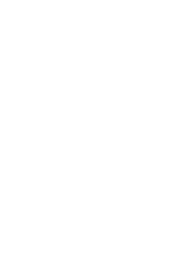

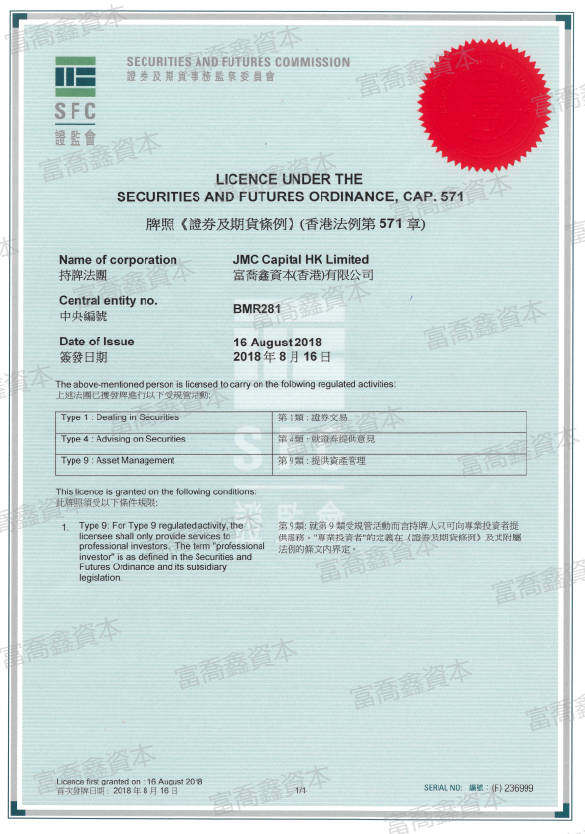

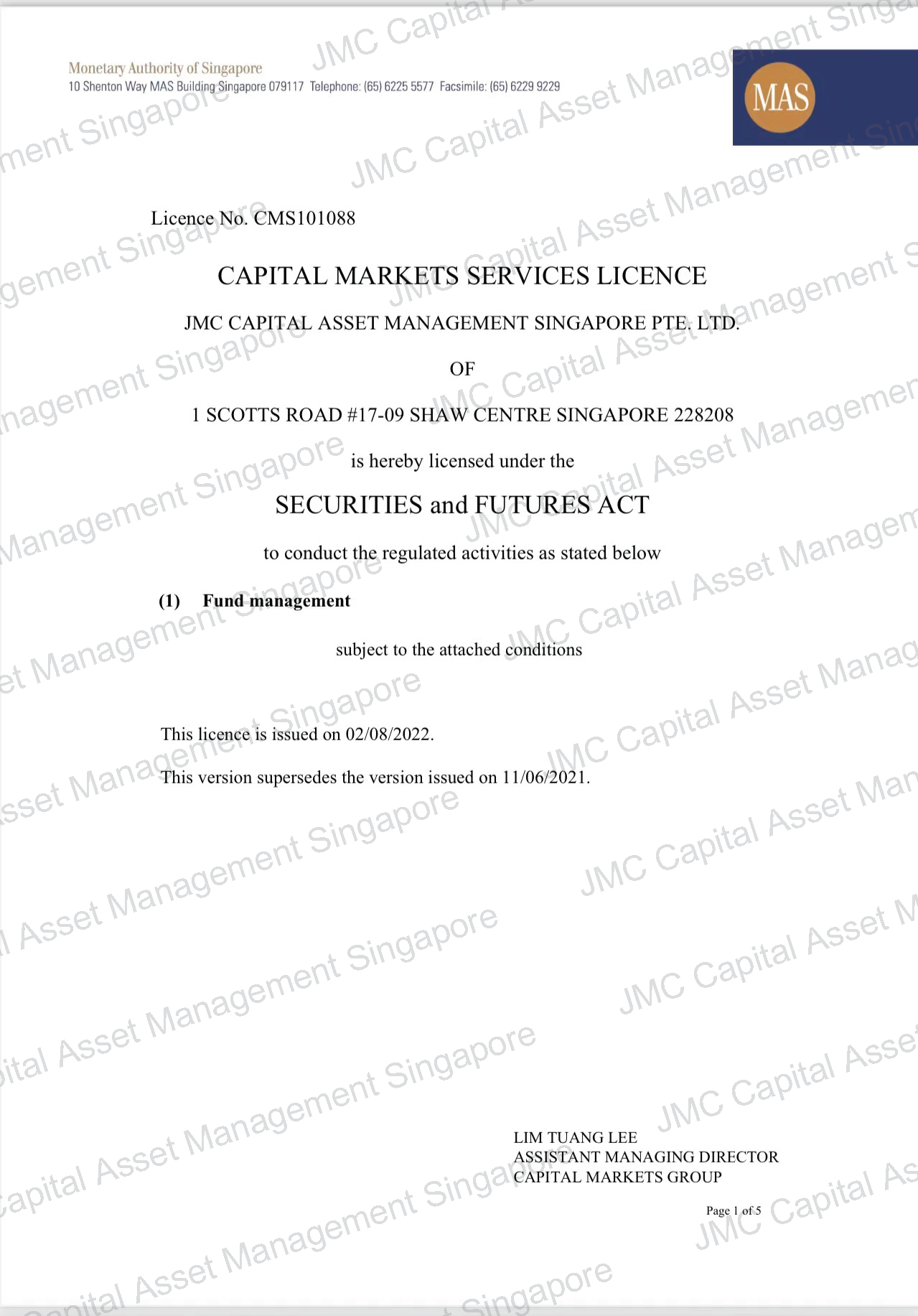

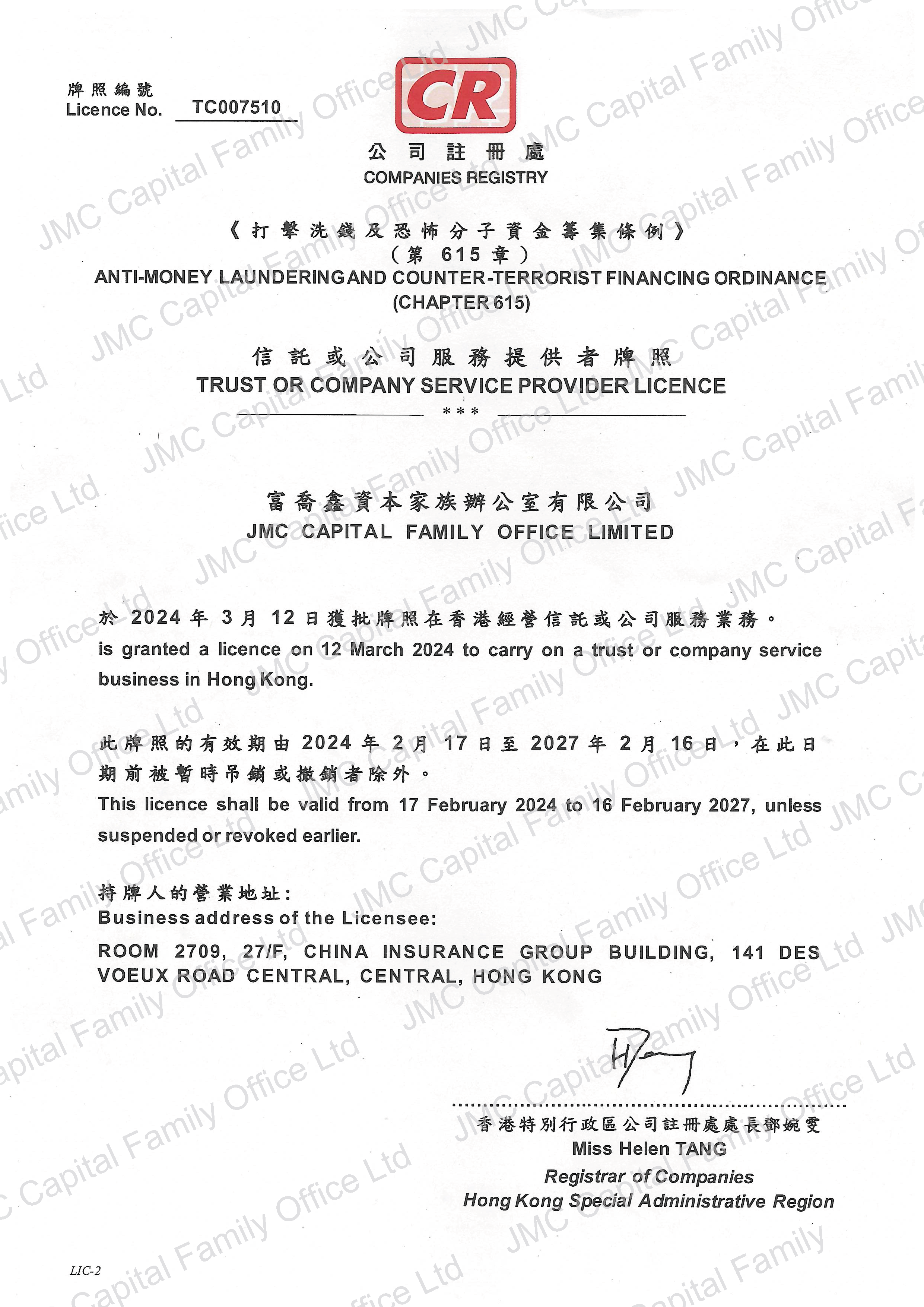

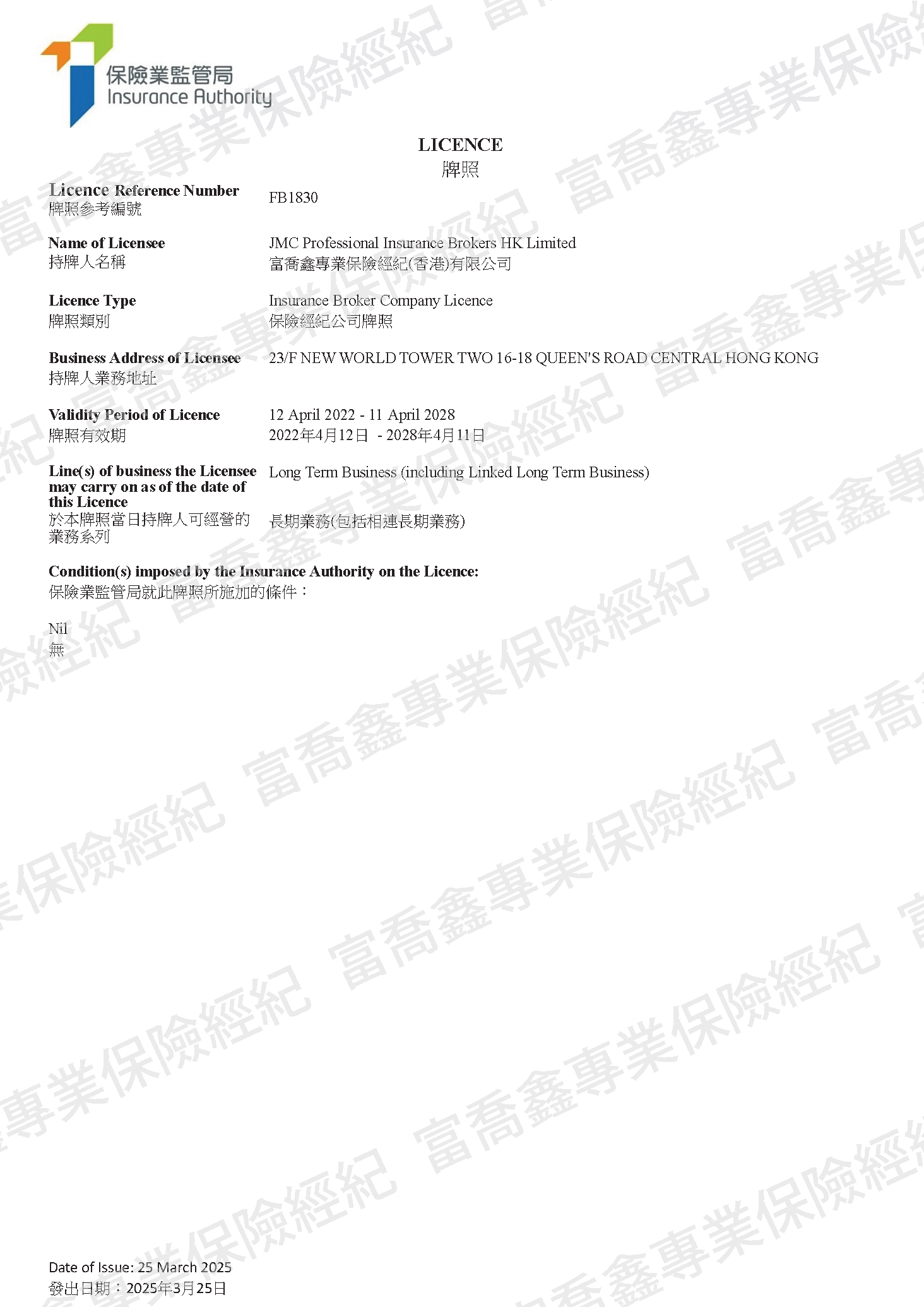

As a comprehensive, fully licensed financial service platform with rigorous internal control, JMC Capital adheres to the values and operating philosophies of “Integrity, Professionalism, Growth and Partnership”, and provides global asset allocation and planning and other comprehensive financial services for high-net-worth individuals and institutional clients. Our services include “family office”, “personal banking and external asset management (EAM)”, “trust set up and tax planning”, “establishment, issuance and management of privately offered funds”, “global insurance”, “wealth preservation and inheritance”, “securities and futures brokerage”, and “overseas immigration and real-estate investment”.

We partner with top private banks, internationally

renowned investment banks, securities brokers and insurance companies across

the globe, such as UBS, Credit Suisse, Morgan Stanley, Goldman Sachs, BNP

Paribas, Citi, EFG Bank, Nomura, DBS, LGT Bank, Leonteq Securities, Vontobel, CICC (HK), CCBI (CCB International), CMBI (CMB International), BOCI

(BOC International) and Huatai Financial Holdings.

JMC Capital has established global investment and custody centers in Hong Kong, Singapore, Switzerland and Liechtenstein. Empowered by a global service network, we have been providing reliable asset allocation services for clients globally.

-images-0-1767846380.jpg)